michigan property tax rates by township

Ada Township had a total taxable value of 986136828 in 2018 of which 81 is residential property. City of Grand Rapids.

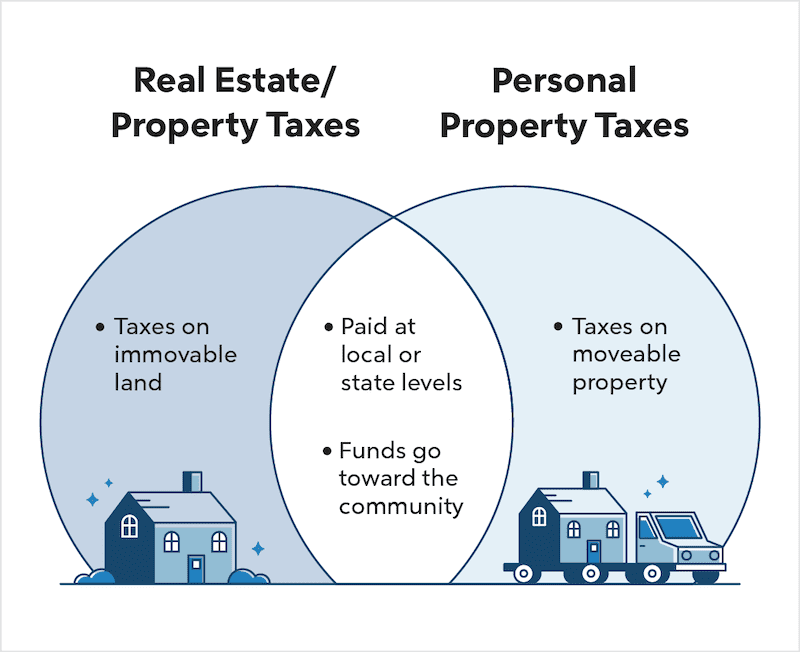

Real Estate Taxes Vs Property Taxes Quicken Loans

You can sort by any column available by clicking the arrows in the header row.

. Michigan has 83 counties with median property taxes ranging from a high of 391300 in Washtenaw County to a low of 73900 in Luce County. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with. Alger Au Train Twp 021010 AUTRAIN-ONOTA PUBLIC 254610 434610 194610 314610 254610 434610 MUNISING PUBLIC SCHOO 274610 454610 214610 334610 274610 454610 SUPERIOR CENTRAL SCH 310495 490495 250495 370495 310495 490495 Burt.

33070 Holt of Total. Michigan case law has long drawn a distinction between ad valorem taxes and traditional special assessments. 2019 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Lee Twp 031120 ALLEGAN PUBLIC SCHOO 314749 494749 254749 374749 354749 534749.

City of Grand Rapids. Average 2016 taxable value of a residential parcel. The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance.

2017 Millage Rates - A Complete List. 84 rows Minnesota. For township millage rates please visit the Township Millage page.

Pontiac School District. Michigan Business Tax Exempt Special Notes. Send your check money order to.

2018 Millage Rates - A Complete List. We are open Monday through Friday from 830 am to 430 pm. Median property tax is 214500.

2020 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY. 2019 Millage Rates - A Complete List. BURT TOWNSHIP SCHOO 274791454791 214791 334791 454791 Grand Island Twp 021030 MUNISING PUBLIC SCHOO 236756416756 176756 296756 416756.

Michigan is ranked number eighteen out of the fifty states in order of the average amount of property taxes collected. For existing homeowners please enter the current taxable value of your property. Township PoliceFire 1 16147.

Millage Rate Property Tax Local Income Tax Total Tax. City of East Grand Rapids. State Summary Tax Assessors.

City of Grand Rapids. 2018 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Lee Twp 031120 ALLEGAN PUBLIC SCHOO 314697 493600 254697 373600 354697 533600 FENNVILLE PUBLIC SCHO 283660 463660 223660 343660 323660 503660 BLOOMINGDALE PUBLIC S 298750 477670 238750 357670 338750 517670 Leighton Twp 031130. For more details about the property tax rates in any of Michigans counties choose the county from the interactive map or the list below.

January 1 - December 31. Many Michigan relocation buyers believe that you are paying taxes for 6 months at a time. Median Annual Property Tax Payment Average Effective Property Tax Rate.

Total taxable value per capita is 67878 based on a population of 14528 residents. This interactive table ranks Michigans counties by median property tax in dollars percentage of home value and percentage of median income. You can now access estimates on property taxes by local unit and school district using 2020 millage rates.

Rate is 186 mills for portion of township in River Valley schools 53538. 2019 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Cheshire Twp 031030 ALLEGAN PUBLIC SCHOOL 331401 511401 271401 391401 331401 511401 BLOOMINGDALE PUBLIC S 315733 495643 255733 375643 315733 495643 Clyde Twp 031040 FENNVILLE PUBLIC SCHO 293224 473224 233224 353224 293224 473224. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

Individual Exemptions and Deferments. The winter tax bill that comes out on December 1st of each year and the summer tax bill that comes out on July 1st of each year. January 1 - December 31.

Counties in Michigan collect an average of 162 of a propertys assesed fair market value as property tax per year. 2021-2022 Statutory Tax Collection Distribution Calendar. For new homeowners please contact the.

Clarkston School District. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. This can be obtained from your assessment notice or by accessing your tax and assessing records on our Property Tax Search website.

Michigan General Property Tax Act. State Equalized Value 75000. Township PoliceFire 2 05561.

SQLSTATEHY000 14 unable to open database file. They are split up into two bills. Simply enter the SEV for future owners or the Taxable Value for current owners and select your county from the drop down list provided.

2021 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Lee Twp 031120 ALLEGAN PUBLIC SCHOO 319946 499946 259946 379946 359946 539946 FENNVILLE PUBLIC SCHO 288656 465848 228656 345848 328656 505848 BLOOMINGDALE PUBLIC S 313285 489191 253285 369191 353285 529191 Leighton Twp 031130. Information regarding personal property tax including forms exemptions and information for taxpayers and assessors regarding the Essential Services Assessment. 2022 Property Tax Calendar.

Ad Find Out the Market Value of Any Property and Past Sale Prices. Average 2016 true cash value of a residential parcel. The list is sorted by median property tax in dollars by default.

33020 Lansing of Total. January 1 - December 31. Personal Property Tax classified 351 up to 18 mills School Operating and 6 mills State Education Tax.

There is a 395 charge for debitcredit card use under 160 and a 2. We accept cash personal checks bank checks MasterCard Discover and Visa. You will then be prompted to select your city village or township along.

2020 Millage Rates - A Complete List. See for example Graham v City of Saginaw 317 Mich 427. 33215 Waverly of Total.

Winter Tax Rates. The second confusing part of Michigan property taxes is how they are collected. Then the local unit must impose a property tax administration fee at a rate equal to the rate of the fee imposed for city or township taxes on that parcel unless there.

Estimate Your Property Taxes Millage Rate Information.

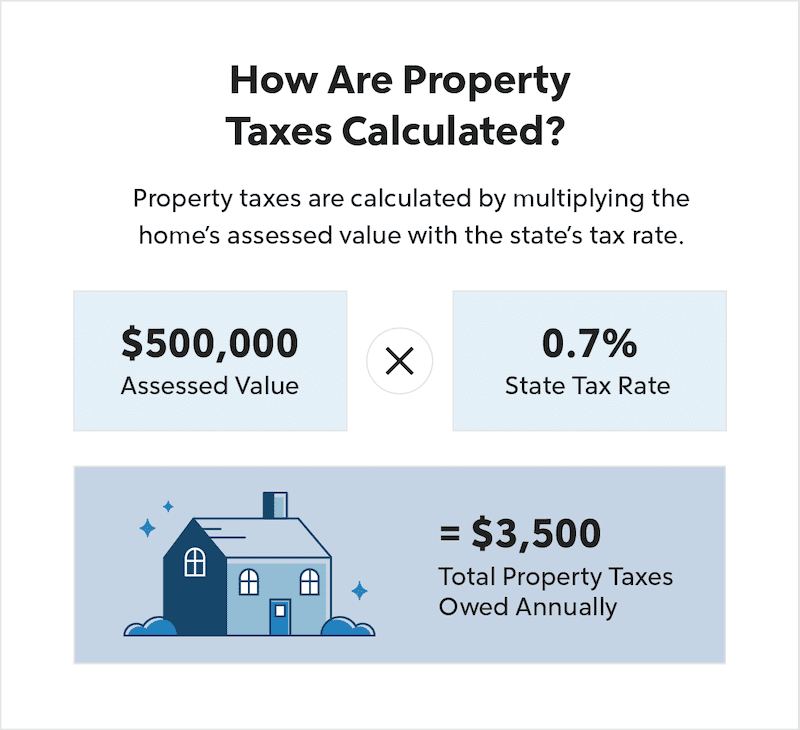

Property Tax How To Calculate Local Considerations

Michigan Property Tax H R Block

Detroit S High Property Tax Burden Stands As An Obstacle To Economic Growth Citizens Research Council Of Michigan

What Do Your Property Taxes Pay For

Michigan S Property Tax Burden And How It Has Changed Over Time Citizens Research Council Of Michigan

Why Are My Property Taxes Higher Than My Neighbor S Credit Com

Winter Tax Bill Example Macomb Mi

Real Estate Taxes Vs Property Taxes Quicken Loans

Property Taxes Hartland Township Michigan

Montgomery County Md Property Tax Calculator Smartasset

How To Calculate Michigan Property Taxes On Your Investment Properties

Did Your Property Tax Bill Send You Into Sticker Shock Open Source Richlandsource Com

A Michigan Man Underpaid His Property Taxes By 8 41 The County Seized His Property Sold It And Kept The Profits Reason Com Property Tax County Tax

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global